The US economic landscape has recently been marked by a confluence of indicators that have ignited concerns about a potential recession. While the nation’s economic engine has demonstrated resilience in recent quarters, a closer examination of key data points reveals a complex and nuanced picture.

This analysis delves into a range of economic signals, encompassing growth, inflation, and employment trends, to provide a comprehensive assessment of the current state of the US economy and the potential risks on the horizon.

Understanding the interplay of these economic forces is paramount for policymakers, businesses, and investors alike. A thorough evaluation of these signals can illuminate the trajectory of the US economy and shed light on the likelihood of a recessionary downturn.

This article will serve as a guide to navigate the intricacies of the current economic environment and provide insights into the factors that could shape the future of the US economy.

The recent data points provide a mixed bag, with some suggesting continued expansion and others pointing to potential headwinds. We will explore the nuances of these indicators to assess their implications for the US economy.

This examination will delve into the strength of GDP growth, the trajectory of inflation, and the evolving dynamics of the labor market. By meticulously analyzing these economic signals, we aim to provide a clear and informed perspective on the current economic environment and the potential for a recessionary scenario.

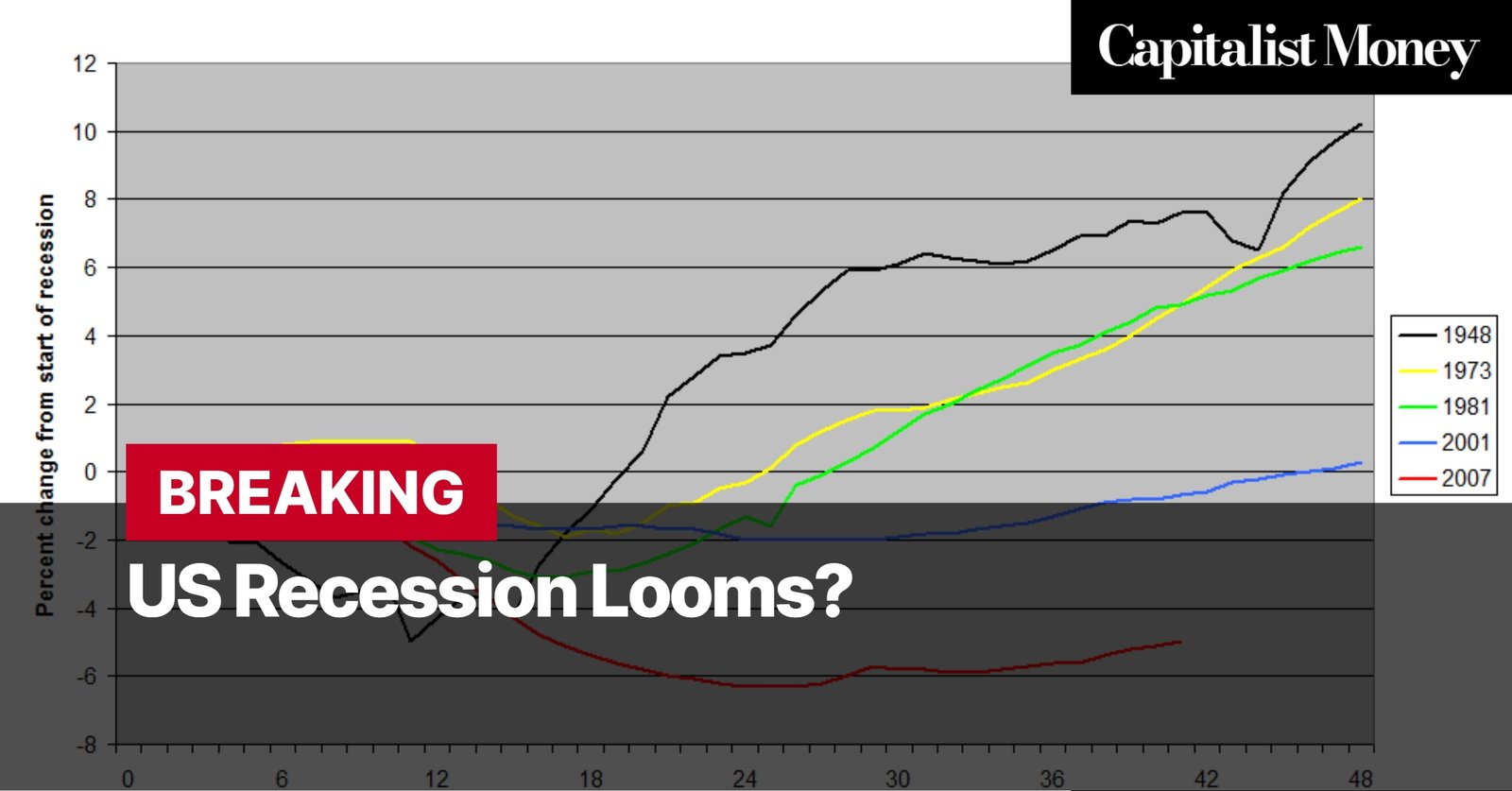

Scrutinizing GDP Growth: A Bellwether for Recessionary Risks

A meticulous examination of GDP growth is paramount when assessing the potential for a recession. The second quarter of 2024 witnessed a 2.8% annualized growth rate, a figure that aligns with the average growth rate observed over the past six quarters and the three years preceding the pandemic.

While seemingly robust, this figure warrants a deeper dive. A closer look reveals a shifting composition of growth, with certain sectors exhibiting signs of deceleration.

Furthermore, the sustainability of this growth trajectory remains a subject of debate among economists, particularly in light of prevailing inflationary pressures and the Federal Reserve’s monetary tightening measures. Understanding the underlying drivers of GDP growth, such as consumer spending, business investment, and government expenditure, is crucial to deciphering the overall health of the economy and its susceptibility to recessionary forces.

A comprehensive analysis should also consider external factors, including global economic conditions and geopolitical uncertainties, which could significantly impact the U.S. economy’s growth prospects.

Navigating the Job Market Labyrinth: Employment Trends and Unemployment Rates

The job market serves as a critical barometer of economic vitality, offering insights into both the current state and future trajectory of the economy. Recent data paints a complex picture, characterized by a slowdown in hiring, with employers adding an average of 170,000 jobs per month over the last three months, a notable decline from the 267,000 monthly average in the first quarter of 2024.

Concurrently, the unemployment rate has ticked upwards, reaching 4.3% in July, its highest point since October 2021. These trends warrant careful consideration, as a sustained rise in unemployment, coupled with a persistent deceleration in hiring, could signal an impending economic downturn.

However, it is equally important to acknowledge the inherent dynamism of the labor market and the potential for these trends to be transitory, influenced by seasonal fluctuations or temporary adjustments within specific industries. A thorough assessment necessitates a granular examination of employment trends across various sectors, demographic groups, and geographic regions to gain a more nuanced understanding of the overall health of the job market.

Inflation’s Enduring Impact: Navigating the Labyrinth of Consumer Spending and Business Investment

Inflation, the persistent upward pressure on prices, continues to cast a long shadow over the economic landscape. While recent data suggests a gradual easing of inflationary pressures, the specter of higher prices continues to weigh on consumer spending and business investment decisions.

The erosion of purchasing power due to inflation can dampen consumer sentiment and lead to a curtailment of discretionary spending, potentially impacting overall economic growth. Similarly, businesses may become more hesitant to invest in new projects or expand operations in an environment of elevated inflation, as the uncertainty surrounding future costs and profitability increases.

Therefore, a vigilant monitoring of inflation trends and their potential ramifications for both consumers and businesses remains crucial. Understanding the underlying drivers of inflation, whether they be supply chain disruptions, surging demand, or monetary policy adjustments, is paramount to formulating effective strategies to mitigate its adverse effects and foster a stable economic environment.

Deciphering Consumer and Business Sentiment: Gauging Economic Confidence

Consumer and business sentiment, often regarded as leading indicators of economic activity, provide valuable insights into the prevailing mood and outlook of key economic actors. A decline in consumer confidence can presage a pullback in spending, while a deterioration in business sentiment can signal a reluctance to invest and hire.

Therefore, closely monitoring these sentiment indicators is essential for anticipating potential shifts in economic behavior and identifying emerging risks. Surveys and indices that track consumer and business confidence can offer valuable insights into their perceptions of the current economic climate and their expectations for the future.

These qualitative assessments, when combined with quantitative economic data, provide a more comprehensive understanding of the underlying dynamics driving economic activity and the potential for future growth or contraction.

Sectoral Performance: A Mosaic of Economic Resilience and Vulnerability

Analyzing the performance of individual sectors, such as manufacturing and services, offers a granular perspective on the strengths and weaknesses of the broader economy. The services sector, a dominant force in the U.S. economy, has demonstrated resilience in recent months, with activity indices indicating continued expansion.

This positive trend suggests that consumer demand for services remains robust, contributing to overall economic growth. However, the manufacturing sector has exhibited signs of softening, with some indicators pointing towards a potential contraction.

This divergence in performance underscores the importance of a sector-specific analysis to identify potential vulnerabilities and areas of concern. Understanding the unique challenges and opportunities faced by each sector allows for a more nuanced assessment of the overall health of the economy and its ability to withstand potential shocks or disruptions.

Furthermore, a sectoral analysis can inform targeted policy interventions aimed at supporting struggling industries and fostering growth in sectors with strong potential.

Navigating the Economic Crossroads: Preparedness and Prudence

The confluence of economic signals paints a complex and nuanced picture of the US economy. While robust GDP growth and a resilient services sector offer glimmers of optimism, the recent uptick in unemployment and rising delinquencies warrant a cautious approach.

Synthesizing these data points suggests that the likelihood of a recession, while not imminent, is a tangible risk that necessitates proactive planning and vigilance. Policy responses, particularly from the Federal Reserve, will play a crucial role in mitigating this risk.

A measured approach to interest rate adjustments, coupled with targeted fiscal measures, could potentially soften the impact of an economic downturn. However, the effectiveness of these policies hinges on their timing and calibration, underscoring the need for continuous monitoring and adaptability.

Businesses and individuals can also take steps to navigate potential turbulence. For businesses, this includes optimizing operational efficiency, diversifying revenue streams, and stress-testing financial plans.

Individuals, on the other hand, should prioritize prudent financial management, including bolstering emergency funds and reviewing investment portfolios. Ultimately, the overall health of the US economy remains a subject of ongoing evaluation.

The dynamism of market forces and the intricate interplay of global events necessitate a constant reassessment of economic indicators. While the current landscape presents challenges, it also underscores the importance of preparedness, resilience, and a commitment to informed decision-making.

By staying informed, adapting to evolving circumstances, and embracing a proactive approach, businesses and individuals can navigate the economic landscape with greater confidence and position themselves for long-term success. The path forward demands a balanced perspective, one that acknowledges both the potential risks and the inherent resilience of the US economy.

This vigilance, combined with a commitment to informed action, will be instrumental in shaping a prosperous future.

- Amad Diallo’s Rise and Manchester Derby Excitement

- Navigating the 2024 and 2025 Tax Landscape: Brackets, Rates, and Planning Ahead

- Palantir: From Shadows to Spotlight, Navigating Controversy and Innovation

- The Relentless Myles Garrett: Battling Through Injury in Browns’ Loss

- Luka’s Triple-Double Dominates as Mavericks Outgun Warriors in Three-Point Barrage