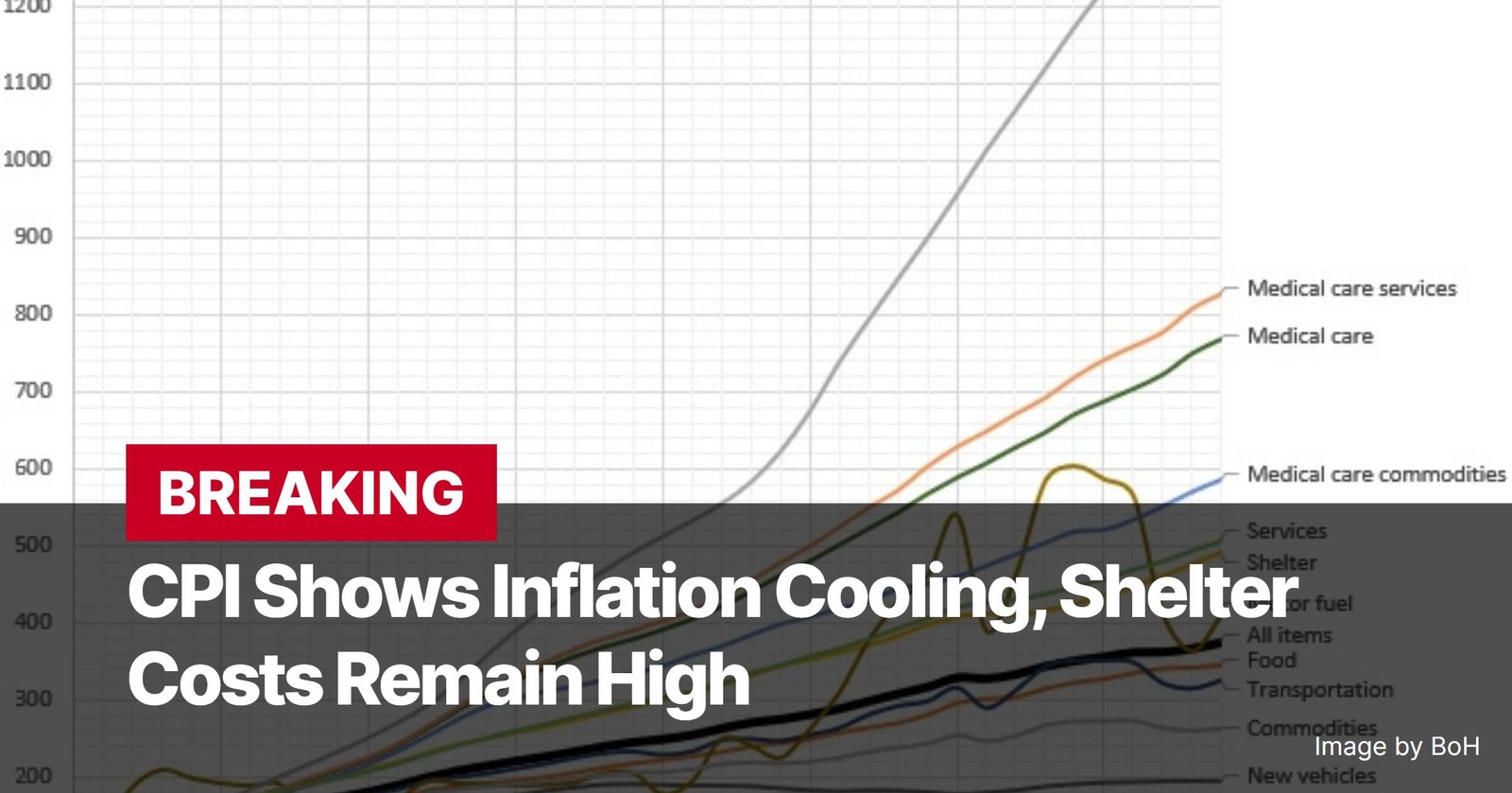

The Consumer Price Index (CPI) for October 2024 reveals a mixed bag for the US economy. While the headline inflation rate cooled slightly, rising shelter costs continue to put pressure on household budgets. This latest report holds significant implications for the Federal Reserve’s monetary policy and the overall economic outlook.

The CPI rose 0.2% in October, bringing the annual inflation rate to 2.6%. This represents a modest decline from the 2.4% annual rate recorded in September and suggests a welcome deceleration in the pace of price increases. Excluding volatile food and energy prices, core inflation rose 0.3% for the month and 3.3% for the year.

One of the key takeaways from this report is the continued surge in shelter costs. While the overall inflation rate has moderated, shelter prices have remained stubbornly high, contributing significantly to the core inflation figure. This trend underscores the challenges facing many American households, as housing remains a major component of their expenses.

The October CPI data also offers insights into other sectors of the economy. Energy prices, which have been a major driver of inflation in recent months, continued their downward trend in October. This decline, largely attributed to falling gasoline prices, is providing some relief to consumers and businesses. However, the report also highlights persistent price pressures in other areas, such as medical care and services.

Looking ahead, the November CPI data, scheduled for release on December 11, 2024, will be closely scrutinized by economists and policymakers. This report will provide further insights into the trajectory of inflation and inform the Federal Reserve’s next policy moves.

Decoding the CPI and Its Importance

The CPI is a crucial economic indicator that tracks changes in the average prices paid by urban consumers for a basket of goods and services. This basket represents typical household spending and includes items like food, energy, housing, transportation, and medical care. The CPI is used to measure inflation, which is defined as a sustained increase in the general price level of goods and services in an economy over a period of time.

Several different CPI measures exist, each providing a unique perspective on inflation. The CPI-U (Consumer Price Index for All Urban Consumers) is the most widely cited measure and covers approximately 93% of the US population. Another important measure, the CPI-W (Consumer Price Index for Urban Wage Earners and Clerical Workers), is used to adjust Social Security benefits and other federal payments.

The CPI is a critical input for monetary policy decisions. Central banks, such as the Federal Reserve, use the CPI and other inflation measures to assess the health of the economy and set interest rates. When inflation is high, central banks may raise interest rates to cool down the economy and bring inflation back to their target level. Conversely, when inflation is low, central banks may lower interest rates to stimulate economic activity.

The Impact of Shelter Costs on Inflation

The persistent rise in shelter costs presents a significant challenge for policymakers. While falling energy prices are helping to moderate headline inflation, rising rents and home prices are pushing core inflation higher. This divergence complicates the Federal Reserve’s task, as it seeks to balance its dual mandate of maximizing employment and maintaining price stability.

The current housing market dynamics are complex. Strong demand, coupled with limited supply, is driving up both rents and home prices. Factors such as increased household formation, shifting demographics, and supply chain disruptions are all contributing to this imbalance. Furthermore, rising mortgage rates are exacerbating affordability issues for many potential homebuyers.

Looking Ahead: Implications and Uncertainties

The October CPI report suggests that inflation may be starting to ease, but significant challenges remain. Shelter costs are a major concern, and their upward trajectory could keep core inflation elevated. The ongoing war in Ukraine, supply chain bottlenecks, and other global economic headwinds continue to pose risks to the inflation outlook.

The Federal Reserve is facing a delicate balancing act. It needs to bring down inflation without triggering a recession. The November CPI report and other upcoming economic data will be crucial in guiding the Fed’s next policy decisions. The path forward remains uncertain, but the October CPI report offers a glimmer of hope that inflation might finally be starting to cool down.